BlackRock går mot att lansera en Ether ETF

- BlackRock väntar på SEC:s godkännande för en spot Bitcoin ETF.

- Priset på Ether steg med över 7% på torsdagen.

- Ark Invest planerar att lansera en ny serie ETF:er för digitala tillgångar med 21Shares.

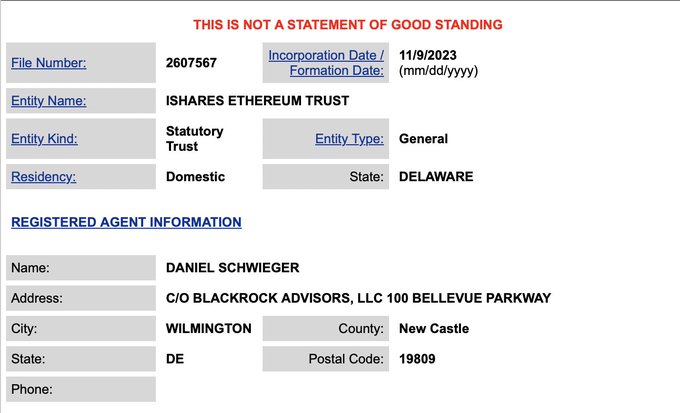

Ethereum, den näst största kryptovalutan efter börsvärde, såg en enorm rally på torsdagen, orsakad av BlackRocks första steg mot en Ether ETF. BlackRock, en kapitalförvaltare har enligt uppgift registrerat en iShares Ethereum Trust i delstaten Delaware.

Delawares Division of Corporations webbplats visade att en enhet identifierad som BlackRock Advisors lämnade in pappersarbetet. Daniel Schwieger finns med i filen som registrerad agent. Schweigers LinkedIn-profil visar att han arbetar som managing director på BlackRock.

BlackRocks iShares-produkt är den ledande börshandlade fonden med över $2,3 biljoner i förvaltat kapital. BlackRock registrerade sitt Bitcoin-trust i juni och ansökte om en Bitcoin ETF hos United States Securities and Exchange Commission (SEC).

Priset på Ether reagerade på BlackRocks nya drag, steg med 7% och passerade $2,000 för första gången sedan april. Ethers kärnrival, Bitcoin, såg en liknande ökning under sommaren när kapitalförvaltare lanserade bud på Bitcoin ETF:er.

Kryptomarknaden är fortfarande optimistisk om att se en Bitcoin ETF i år. SEC har dock ännu inte beviljat ett sådant godkännande. Den amerikanska vakthunden har uttryckt oro över en Bitcoin ETF och hindrat Grayscale från att förvandla sin Bitcoin trust-produkt till en ETF. En domare upphävde SEC:s beslut i augusti.

De SEC valde att inte överklaga domen men kunde komma med andra skäl för att stoppa Grayscales konvertering och eventuella andra bitcoin-medel som övervägs. Många tror att SEC kan godkänna eterfonder efter att det tillåter bitcoin-ETF:er.

BlackRocks föreslagen spot bitcoin ETF har enligt uppgift starkt stöd från finansvärlden. Enligt rapporter överväger stora handelsföretag som Jane Street, Virtu Financial och Jump Trading att tillhandahålla likviditet till den nya produkten om den godkänns av tillsynsmyndigheter.

I andra nyheter har Bitcoin-investeringsexperten Cathie Wood från ARK Invest och leverantören av börshandlade produkter (ETP) 21Shares samarbetat för att introducera en ny linje av ETF:er för digitala tillgångar. Det nya partnerskapet kommer påstås ge investerare som vill inkludera digitala tillgångar i sin handelsportfölj ett bredare utbud av alternativ.

21Shares skrev i ett uttalande:

Med hjälp av onchain-signaler och vår kryptobaserade erfarenhet, syftar sviten till att leverera långsiktig kapitaltillväxt genom strategiska investeringar i Bitcoin och Ethereum terminskontrakt och tillämpning av blockchain-teknologier.

Enligt tillkännagivandet kommer Chicago Board Options Exchange, eller Cboe, att lista ETF:erna. Dessutom kommer fem produkter att börja handlas nästa vecka, enligt 21Shares.

Ark noterade dock att fonderna inte erbjuder investerare en chans att investera direkt i digitala tillgångar. Investeringsbolaget noterade att "varken fonderna eller den underliggande ETF:n investerar direkt i bitcoin eller andra digitala tillgångar eller upprätthåller direkt exponering för spotbitcoin... Investerare som söker direkt exponering för priset på bitcoin bör överväga en annan investering än fonderna."