BlackRock avança para lançar um ETF Ether

- A BlackRock está aguardando a aprovação da SEC para um ETF Bitcoin à vista.

- O preço do Ether subiu mais de 7% na quinta-feira.

- Ark Invest está planejando lançar um novo conjunto de ETFs de ativos digitais com 21Shares.

Ethereum, a segunda maior criptomoeda em capitalização de mercado, teve uma grande recuperação na quinta-feira, causada pelo primeiro passo da BlackRock em direção a um ETF Ether. BlackRock, um gestor de ativos supostamente registrou um iShares Ethereum Trust no estado de Delaware.

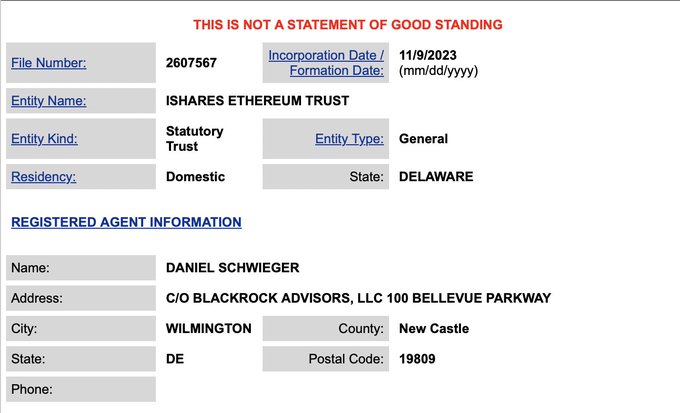

O site da Divisão de Corporações de Delaware mostrou que uma entidade identificada como BlackRock Advisors apresentou a papelada. Daniel Schwieger está listado no arquivo como agente registrado. O perfil de Schweiger no LinkedIn mostra que ele trabalha como diretor administrativo na BlackRock.

O produto iShares da BlackRock é o principal fundo negociado em bolsa, com mais de $2,3 trilhões em ativos sob gestão. A BlackRock registrou seu fundo Bitcoin em junho e entrou com um pedido de ETF Bitcoin junto à Comissão de Valores Mobiliários dos Estados Unidos (SEC).

O preço do Ether reagiu ao novo movimento da BlackRock, subindo 7% e ultrapassando $2.000 pela primeira vez desde abril. O principal rival do Ether, o Bitcoin, teve um aumento semelhante durante o verão, quando os gestores de ativos lançaram ofertas para ETFs de Bitcoin.

O mercado de criptografia continua otimista em ver um ETF Bitcoin este ano. No entanto, a SEC ainda não concedeu tal aprovação. O órgão de fiscalização dos EUA expressou preocupação sobre um ETF Bitcoin e impediu a Grayscale de transformar seu produto fiduciário Bitcoin em um ETF. Um juiz anulou a decisão da SEC em agosto.

o SEC optou por não apelar da decisão, mas poderia apresentar outras razões para interromper a conversão da Grayscale e quaisquer outros fundos de bitcoin que estivessem sendo considerados. Muitos acreditam que a SEC poderia aprovar fundos de éter depois de permitir ETFs de bitcoin.

BlackRock proposto O ETF spot bitcoin supostamente tem forte apoio do mundo financeiro. Segundo relatos, grandes empresas comerciais como Jane Street, Virtu Financial e Jump Trading estão considerando fornecer liquidez para o novo produto, se aprovado pelos reguladores.

Em outras notícias, a especialista em investimentos em Bitcoin Cathie Wood da ARK Invest e o provedor de produtos negociados em bolsa (ETP) 21Shares formaram uma parceria para introduzir uma nova linha de ETFs de ativos digitais. A nova parceria supostamente proporcionará aos investidores que buscam incluir ativos digitais em sua carteira de negociação uma gama mais ampla de opções.

21Shares escreveu em um comunicado:

Aproveitando os sinais onchain e nossa experiência cripto-nativa, o pacote visa proporcionar valorização de capital de longo prazo por meio de investimentos estratégicos em contratos futuros de Bitcoin e Ethereum e da aplicação de tecnologias blockchain.

De acordo com o anúncio, a Chicago Board Options Exchange, ou Cboe, listará os ETFs. Além disso, cinco produtos começarão a ser negociados na próxima semana, de acordo com a 21Shares.

Ark, no entanto, observou que os fundos não oferecem aos investidores a oportunidade de investir diretamente em ativos digitais. A empresa de investimento observou que “nem os fundos nem o ETF subjacente investem diretamente em bitcoin ou outros ativos digitais ou mantêm exposição direta ao bitcoin à vista… Os investidores que buscam exposição direta ao preço do bitcoin devem considerar um investimento diferente dos fundos”.