Mark Cuban sagt, es sei nahezu unmöglich festzustellen, welche Kryptowährung ein Wertpapier sei

- Mark Cuban glaubt, dass es der US-Börsenaufsichtsbehörde SEC nicht gelungen ist, einen klaren Weg zur Regulierung für Kryptofirmen aufzuzeigen.

- Er sagte, dass es “ohne eine Armee von Wertpapieranwälten” unmöglich sei, festzustellen, welches Krypto-Asset ein Wertpapier sei.

- Die SEC hat kürzlich in einer Klage gegen Coinbase viele Münzen wie SOL, MATIC, AXS, ADA usw. als Wertpapiere gekennzeichnet.

- Cuban stellte fest, dass andere Finanzbranchen von der SEC mehr Transparenz erfahren.

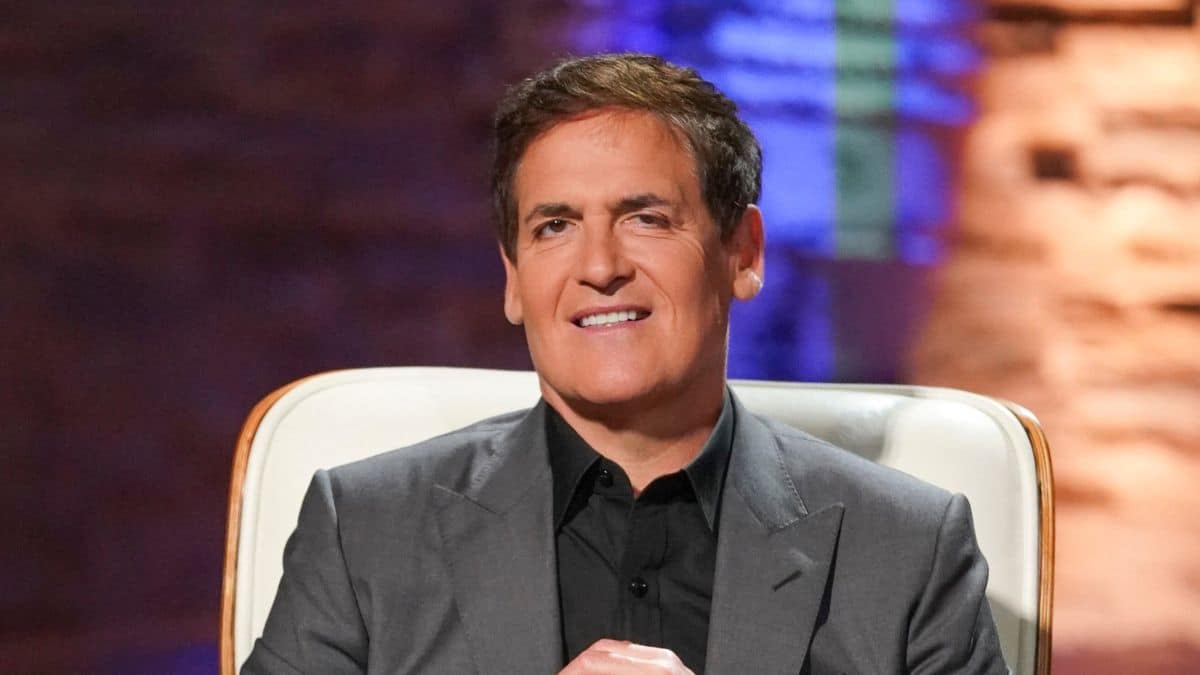

Mark Cuban, der milliardenschwere Besitzer der Dallas Mavericks und Investor der Ethereum-Skalierungslösung Polygon (MATIC), gehört zu den vielen, die sich gegen die US-Börsenaufsichtsbehörde (SEC) und deren rigorose Regulierungsmethoden gegenüber Krypto-Unternehmen ausgesprochen haben. Der SEC-Vorsitzende Gary Gensler hat mehrfach erklärt, dass mit Ausnahme von Bitcoin (BTC) alle anderen Kryptowährungen als Wertpapiere gelten.

Der Milliardär erklärte, die SEC habe es offensichtlich versäumt, Kryptowährungsunternehmen einen transparenten Registrierungsprozess zu bieten und dadurch regulatorische Unsicherheit in der Branche geschaffen, was Blockchain-Unternehmen aus der US-Wirtschaft vertreibe. Mark Cuban wies zudem darauf hin, dass es im “Rahmenwerk für die Analyse digitaler Vermögenswerte als ‘Investitionsverträge’” der SEC keine Registrierungspflicht gebe.” dokumentieren über einen 11. Juni twittern.

Wie zuvor von Bitnation berichtet, die SEC verklagte die größte Krypto-Börse In den USA gab Coinbase in der Klage an, dass mehrere von der Börse angebotene Münzen Wertpapiere seien, darunter Solana (SOL), Polygon (MATIC), Axie Infinity (AXS), Chiliz (CHZ), Nexo (NEXO) und Cardano (ADA) usw.

“Leider ist keines der auf dieser Seite dargestellten Elemente Teil des Registrierungsprozesses. Das macht es nahezu unmöglich, selbst mit einem Heer von Wertpapieranwälten, zu wissen, was im Kryptouniversum ein Wertpapier ist und was nicht”, sagte Cuban.

Die SEC stellt keine detaillierte Schritt-für-Schritt-Anleitung bereit, erläutert aber kurz die Anforderungen an Krypto-Unternehmen, die die geltenden Gesetze einhalten wollen. Unter anderem müssen die Unternehmen alle Informationen offenlegen, die für Anleger entscheidend sind, um fundierte Anlageentscheidungen zu treffen und andere wesentliche Managementaufgaben wahrzunehmen.

Mark Cuban merkte an, dass andere Finanzbranchen mehr Transparenz seitens der SEC erleben, und erklärte, dass “Wertpapierleihe” von der Aufsichtsbehörde nicht als Wertpapiere eingestuft würden und dass man, anstatt die Broker und Banken zu verklagen, ein “Kommentarverfahren” durchführe.”

“Sie sollten das Gleiche mit Kryptowährungen tun, um herauszufinden, welche Aspekte von Kryptowährungen Wertpapiere sind und welche nicht”, sagte der Investor aus der Fernsehsendung „Shark Tank“.