Gary Wang compartilha uma visão mais chocante no depoimento de sexta-feira

- Gary Wang afirmou que a Alameda desfrutou de benefícios especiais da FTX, incluindo fazer saques diretos.

- Bankman-Fried ordenou a Wang que ajustasse o código da FTX para permitir que a Alameda Research negociasse mais do que tinha disponível.

- Os promotores afirmam que o Bankman-Fried enganou os clientes da FTX ao usar seus fundos sem o seu consentimento.

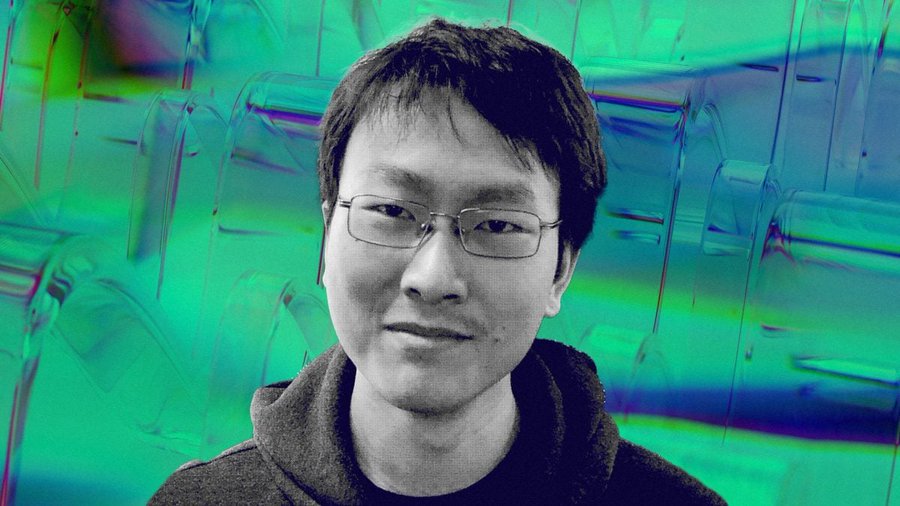

Na sexta-feira, ocorreu o quarto dia do julgamento criminal de Bankman-Fried, e o cofundador e ex-diretor de tecnologia da FTX, Gary Wang, compareceu novamente ao tribunal para discutir os laços entre a FTX e a Alameda Research.

Wang compartilhou informações ainda mais chocantes sobre a relação entre as duas empresas irmãs, acrescentando que a conta da Alameda na FTX permitia que eles negociassem mais do que o disponível — um recurso conhecido como "permitir negativo". Segundo relatos, o ex-executivo da FTX afirmou que Bankman-Fried queria tratamento especial para a Alameda Research.

Bankman-Fried teria ordenado a Wang e ao ex-diretor de engenharia da FTX, Nishad Singh, que alterassem o código da FTX em 2019 para permitir que a Alameda retirasse fundos ilimitados. Wang explicou que esse recurso era um dos benefícios que a Alameda Research desfrutava e que não era divulgado ao público.

De acordo com Segundo Wang, a alteração nas regras da FTX que permitia saldos negativos possibilitou que a Alameda registrasse um saldo negativo de 1.400.200 milhões de rupias, em contraste com o lucro de 1.400.150 milhões de rupias da FTX em 2020. Ele alegou ainda que, apesar de fazer afirmações falsas sobre a relação entre as duas empresas, Bankman-Fried concedeu à Alameda uma linha de crédito de 1.400.65 bilhões de rupias.

Wang teria dito no tribunal:

Tínhamos dito que não usaríamos os fundos dessa forma. Depois que mencionei que os saldos da Alameda estavam errados em bilhões, [Bankman-Fried] pediu para se encontrar comigo no escritório das Bahamas. Ele me perguntou sobre o problema e, em seguida, disse a Caroline que a Alameda podia prosseguir com a devolução dos empréstimos.

Wang observou que Alameda tinha permissão para fazer saques diretos da FTX. Os promotores acusaram Bankman-Fried de fraude. No entanto, o cerne da acusação contra o ex-magnata das criptomoedas é que ele supervisionou o uso dos fundos dos clientes da FTX sem a permissão deles.

Wang e outros executivos da FTX se declararam culpados das acusações e estão cooperando com os promotores no caso contra Bankman-Fried. Curiosamente, Wang e Bankman-Fried eram colegas de quarto na faculdade antes de trabalharem juntos na FTX.

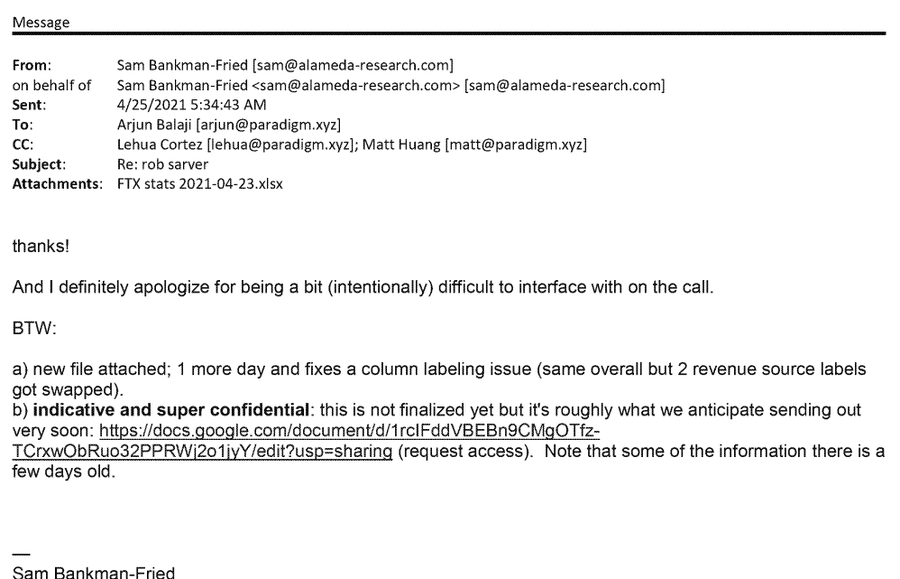

Wang é o primeiro da lista de ex-executivos da FTX a depor, mas o júri já ouviu o depoimento de outras três testemunhas. Ex-usuários da FTX disseram que não conseguiram sacar seu dinheiro quando a corretora faliu, enquanto Matt Huang, gerente de uma empresa focada em criptomoedas que investiu na FTX, afirmou ter sido informado de que Alameda não gozava de "tratamento preferencial" no sistema.

O ex-programador de computador da FTX Adam Yedidia, que trabalhou com Wang, disse que alertou Bankman-Fried sobre suas suspeitas meses antes do desastroso colapso. Yedidia ficou preocupado depois de descobrir que a Alameda havia tomado emprestado 1.480 bilhões de dólares da FTX. Ele afirmou que Bankman-Fried expressou preocupações semelhantes sobre o futuro da empresa, admitindo que elas não eram tão "à prova de balas" quanto haviam sido meses antes.