Kevin O'Leary von Shark Tank wollte FTX helfen

- Kevin O'Leary sagte, dass er von mehreren Staatsfonds und Pensionsfonds angesprochen worden sei, da diese ihn baten, FTX dabei zu helfen, die Lücke von 1TP4B8 Milliarden in ihrer Bilanz zu schließen.

- Während der Millionär Sam Bankman-Fried helfen wollte, als dieser ihn einen Tag vor dem Insolvenzantrag kontaktierte, hinderten ihn Aussagen des SEC-Vorsitzenden Gary Gensler daran.

- Gensler ist der Ansicht, dass der Kryptosektor “in erheblichem Maße nicht regelkonform” ist und dass daher zusätzliche regulatorische Bestimmungen zum Schutz der Gelder der Anleger eingeführt werden müssen.

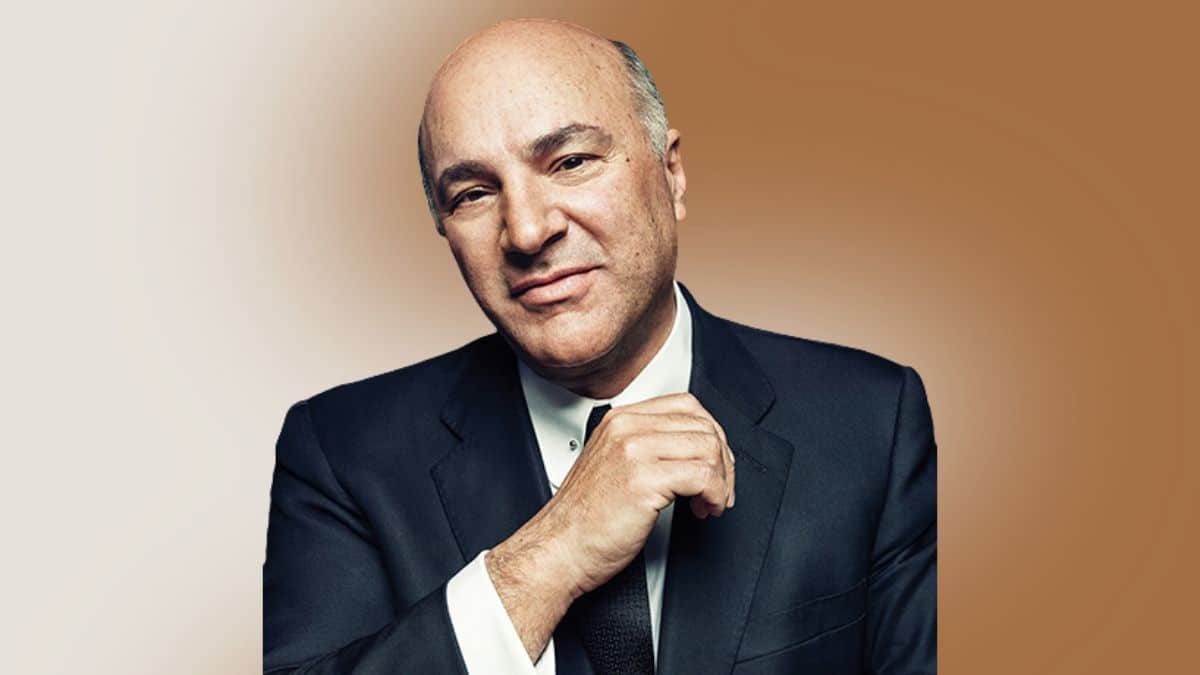

Kevin O'Leary, der beliebte Investor aus der Fernsehsendung “Shark Tank” und bekannt als „Mr. Wonderful“, war zuvor Botschafter und bezahlter Sprecher der mittlerweile insolventen Kryptobörse FTX, als diese noch von ihrem Gründer Sam Bankman-Fried geleitet wurde. Auf Drängen vieler beschloss der Millionär, das auf den Bahamas ansässige Unternehmen zu retten, ruderte jedoch nach einer beunruhigenden Aussage des Vorsitzenden der US-Börsenaufsichtsbehörde (SEC), Gary Gensler, zurück.

In einem (n Interview, O'Leary gab an, dass er einen Tag vor dem Insolvenzantrag von FTX von Bankman-Fried kontaktiert worden sei, und zwar von dem ehemaligen Krypto-Milliardär, dessen Das Nettovermögen ist auf null gesunken, Er bat den prominenten Geschäftsmann um Hilfe für sein angeschlagenes Unternehmen. O'Leary hielt es zunächst für eine gute Idee, die Börse zu retten und so eine starke Position in der Kryptoindustrie zu schaffen.

“Solche Summen können Institutionen oder Staatsfonds investieren, wenn sie darin eine interessante Gelegenheit sehen”, sagte O’Leary. “Im Finanzdienstleistungssektor können Liquiditätsereignisse wie dieses interessante Investitionsmöglichkeiten darstellen, vorausgesetzt, man hält die Investition für legitim und es bestehen keine aufsichtsrechtlichen Bedenken.”

Laut O'Leary gab es mehrere Staatsfonds und Pensionsfonds, die sich an ihn wandten und ihn baten, FTX dabei zu helfen, die Lücke von 1TP4B8 Milliarden in ihrer Bilanz zu schließen.

Kevin O'Leary verwirft die Idee

Kevin O'Leary erwog zwar eine Investition in FTX, verwarf den Plan jedoch nach einer wichtigen Aussage des SEC-Vorsitzenden Gary Gensler. Dieser erklärte, der Kryptosektor sei “erheblich nicht regelkonform”, weshalb zusätzliche regulatorische Maßnahmen zum Schutz der Anlegergelder eingeführt werden müssten. Dies war für den Geschäftsmann ein deutliches Warnsignal, da er wusste, dass eine Investition in FTX mit erheblichem regulatorischem Widerstand verbunden sein würde.

“In dem Moment, als das geschah, war das Interesse jedes Staatsfonds erloschen”, sagte O’Leary. “Es gab keine Möglichkeit, diese 1,4 Billionen US-Dollar in die Bilanz von FTX einzubringen, solange die Regulierungsbehörden darüber wachten.”

Die Rolle von Mr. Wonderful bei FTX

Kevin O'Leary war einst einer der größten Unterstützer der Kryptobörse FTX und betonte wiederholt, dass Sam Bankman-Fried vertrauenswürdig sei, da beide Elternteile aus dem juristischen bzw. politischen Umfeld stammten. Infolgedessen wurde er im August 2021 durch einen Deal, in dem er Firmenanteile erhielt und für seine Tätigkeit als Botschafter und Sprecher der Börse mit Kryptowährung bezahlt wurde, maßgeblich an der Börse beteiligt.

“FTX nutzt erstklassige Technologie, um sowohl professionellen als auch privaten Anlegern ein qualitativ hochwertiges Handelserlebnis mit niedrigen Gebühren zu bieten und gleichzeitig eine Berichtsplattform bereitzustellen, die sowohl interne als auch regulatorische Compliance-Anforderungen erfüllt”, sagte Kevin O'Leary, als er die Dienstleistungen von FTX lobte.